When in Doubt, Zoom Out: The Sensex 150,000 Prediction by 2029

Viral Sheth

11/11/20242 min read

Ramdeo Agarwal, Chairman of Motilal Oswal Financial Services, recently shared his bullish view on the Sensex, predicting it could reach 150,000 by 2029. His optimism is based on solid fundamentals:

Corporate India has compounded profits at about 17% annually over the past 30 years, and

he expects around 15% growth to continue

—doubling the Sensex within five years if valuations remain steady (PE multiple of 25).

What’s driving this? A retail equity boom. Individual investors are flocking to stocks, infusing companies with liquidity to fuel expansion. This ongoing momentum builds a “wealth effect,” as rising share prices lift investor confidence and encourage even more participation.

Strong Fundamentals Back This Up

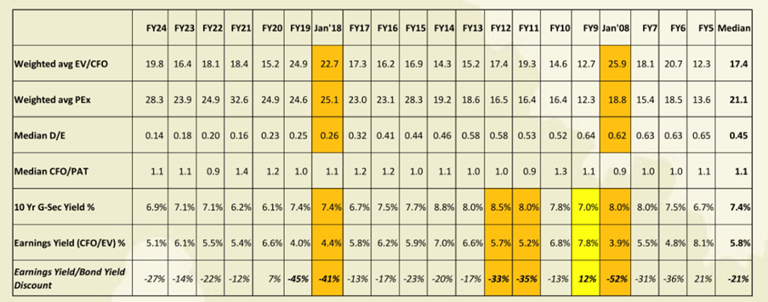

On the fundamentals side, a recent memo from Sage One Investment highlights that Indian companies are in a healthier position than they’ve been at previous market peaks. Debt-to-equity ratios are at historic lows (0.14 for FY24 compared to 0.26 in 2018). Additionally, the EV/CFO ratio (Enterprise Value to Cash Flow) is lower than in 2018 and 2008, suggesting there’s room for growth before reaching overvaluation territory.

The table in the memo presents data for 1,000 Indian non-finance companies with a listing history of over 20 years

Source: Sage one Investment memo dated 22-10-2024 ,

Technicals Tell a Similar Story

The monthly Sensex chart from 1992 to 2024 shows that major crashes typically followed steep, unsustainable rises. Right now, we’re nowhere near those red flags. The current dip looks more like a correction than a crash.

Bottom Line: This Is a Correction, Not a Collapse

With corporate fundamentals solid and no technical signs of a major downturn, now could be an opportune time to invest with the long-term in mind. If you’re questioning short-term market movements, take a step back. So I always advice: “When in doubt, zoom out.”

Contact Details

Finansys

33, 7th Floor; AC Market, Tardeo, Mumbai 34

Phone: +91 9930378858